Welcome to Internal Tech Emails: internal tech industry emails that surface in public records. 🔍 If you haven’t signed up, join 35,000+ others and get the newsletter:

Memo from Sam Bankman-Fried on “a one-stop shop for relationships”

February 2022

In LA last weekend, I met with Michael Kives and his firm, K5.

He is, probably, the most connected person I’ve ever met. In attendance at the dinner at his house were:

1) Hillary Clinton

2) Doug Emhoff

3) Katy Perry

4) Orlando Bloom

5) Kate Hudson

6) Leonardo DiCaprio

7) Jeff Bezos

8) Ted Sarandos

9) Kendall Jenner

10) Kris Jenner

11) Corey Gamble

Etc.

He seems to be genuinely close to them–e.g. is vacationing with Katy/Orlando/Kate right now, Bill/Hillary spoke at his wedding, etc.

He’s been very friendly to us, and already started to create valuable relationships. He intro’d me to everyone I asked at the party and was open/active in doing so.

K5 is his firm with his cofounder, Bryan Baum. It’s a joint VC-firm and incubator, for e.g. 818 Tequila (with Kendall Jenner).

They want with us:

1) A guide to the crypto industry

2) Co-investments and sharing dealflow

3) Us to consider endorsements with their friends

4) Us to be added to their club

5) Us to work with them on Democratic politics

6) Maybe us to invest in them or some stuff, idk

We can get from them:

1) Essentially infinite connections. I think that if we asked them to arrange a dinner with us, Elon, Obama, Rihanna, and Zuckerberg in a month, they would probably succeed.

2) Potential endorsement deals

3) Potential unpaid partnerships with celebrities

4) Working together on electoral politics

5) Political relationships

FWIW I’ve generally gotten good vibes from them.

Bryan is going to be visiting the office tomorrow; he lives in Miami most of the time, the rest mostly live in LA.

I think this should substantially change some things. In particular I think it’s something of a one-stop shop for relationships that we should utilize, and can supersede a lot of other things we have.

[This document is from U.S. v. Samuel Bankman-Fried (2023).]

Sam Bankman-Fried messages Vox writer

November 16, 2022

[This document is from U.S. v. Samuel Bankman-Fried (2023).]

Further reading from Kelsey Piper for Vox: Sam Bankman-Fried tries to explain himself (November 16, 2022)

Sam Bankman-Fried emails VCs

On Thu, Apr 22 2021 at 10:06 AM, Sam Bankman-Fried wrote:

Hey guys --

I was wondering if you could give more context on conversations you've been having with other VCs. I suspect that a somewhat garbled version of those is leaking out and being reframed as coming from us...

On April 23, 2021, 1:14 AM GMT+8 Matt Huang wrote:

Hi Sam:

We've just been chatting with a few folks we know and often collaborate with (Tiger, MFN, Ribbit, Coatue) to compare notes on the opportunity.

The discussion / consensus seems to be:

1) everyone loves you, SBF + the core FTX platform

2) $20B is a very high price (even for Tiger and Coatue who are setting price records in the private markets)

What is the message that you think is leaking?

On Thu, Apr 22 2021 at 10:24 AM, Sam Bankman-Fried wrote:

"Word on the street" is that we're asking for $12B val.

90% sure it's coming from those conversations.

Not super appreciative of that, though no reason to think it's you guys in particular, could be coming from any one of them.

Frankly a pretty bad look given the Coinbase holdings many of that group have, makes us wonder what the motivation behind it is.

I'm not sure what your guys thoughts are on the raise but maybe to be more explicit about this: it's totally fine if you want a $12b val, but we don't, and we would rather just not raise, which is totally fine with us! Also lots of others are happy with 20b, and FTT implies a much higher val, so would be kinda weird for us to raise a 10-12 from a group of people who have not historically been very aligned with us. Super happy to keep talking about the raise if you want, and happy to talk about valuation if you have a convincing case for it!

I'm not really sure how we as a community got to where we are -- we should be looking to work together in the crypto space, not fight each other, and things seem surprisingly sectarian -- though at some point vested interest in projects might just cause that, which could just be a prisoner's dilemma.

I'm happy to hop on a call to discuss if helpful--we have one scheduled for tomorrow--but wanted to jump on this fairly quickly because it's very important to us that there be honesty in this process and we suspect that somewhere near here misleading information is being passed behind our backs.

And again -- don't mean this as specifically targeting you guys -- could just as easily be any of the others.

On April 23, 2021, 1:27 AM GMT+8 Matt Huang wrote:

Hi Sam: happy to talk through it. We have never thought about "12" as a number, much less talked about that number with anyone. It also is not in our interest to do anything to harm you or FTX — we are long crypto more than we are long any particular company, and we all benefit from good actors like you building successfully. I would be surprised if this chatter is coming from us, or anyone we associate with — this is not how high quality venture/growth investors behave.

On Thu, Apr 22, 2021 at 10:33 AM, Sam Bankman-Fried wrote:

Got it -- hearing a lot of inconsistent things here between you, the others, and third hand sources about it.

Happy to chat about it!

On April 23, 2021, 4:35 AM GMT+8 Arjun Balaji wrote:

Hi Sam, apologies for what looks like a messy game of telephone here.

Re-affirming that we haven't discussed or considered "12B", so genuinely confused where that's coming from. Simply put, our interest in a potential partnership with FTX (or anyone, really) comes from optimism about the long-term potential of the business and the positive impact it can have.

In the interest of transparency: we are (of course) impressed by the scale you've accomplished so quickly, but we *do* have some concerns, briefly outlined below.

1) Governance. As we understand, FTX is effectively owned + controlled by Sam, lacking more traditional corporate governance model, rights, etc. One example of where this can negatively manifest with crypto companies is through (unintended) value leakage, e.g. via FTT, Alameda, or some other mechanism. Like you, we place a *heavy* emphasis on alignment. As a shareholder, we'd want confidence that the value FTX creates accrues directly to equity holders. We're not suggesting that this isn't the case today; just that, candidly, we aren't sure how to think about it yet.

2) Price. Thanks for your earlier feedback; let's discuss live tomorrow.

Our lens may be colored by our sense of the highest order goal: paving the best path to FTX building an enduring franchise, and (eventually) listing as a public company. I don't think we're misaligned on this goal, so perhaps the disagreement is on how to maximize success to that end.

In any case, appreciate your patience and look forward to discussing in higher resolution tomorrow.

[This document is from U.S. v. Samuel Bankman-Fried (2023).]

Further reading from Zack Abrams for The Block: “Paradigm's Huang described the process by which the VC firm decided to invest a total of around $278 million into FTX over two rounds. Huang said that FTX's early rapid growth in market share excited him, but that he was concerned by FTX's lack of a formal governance structure or even a board of directors. Huang also recalled being told by Bankman-Fried that Alameda Research had no preferential treatment on the FTX exchange. As far as Paradigm’s investment? ‘We have marked it to zero,’ Huang stated.” (October 5, 2023)

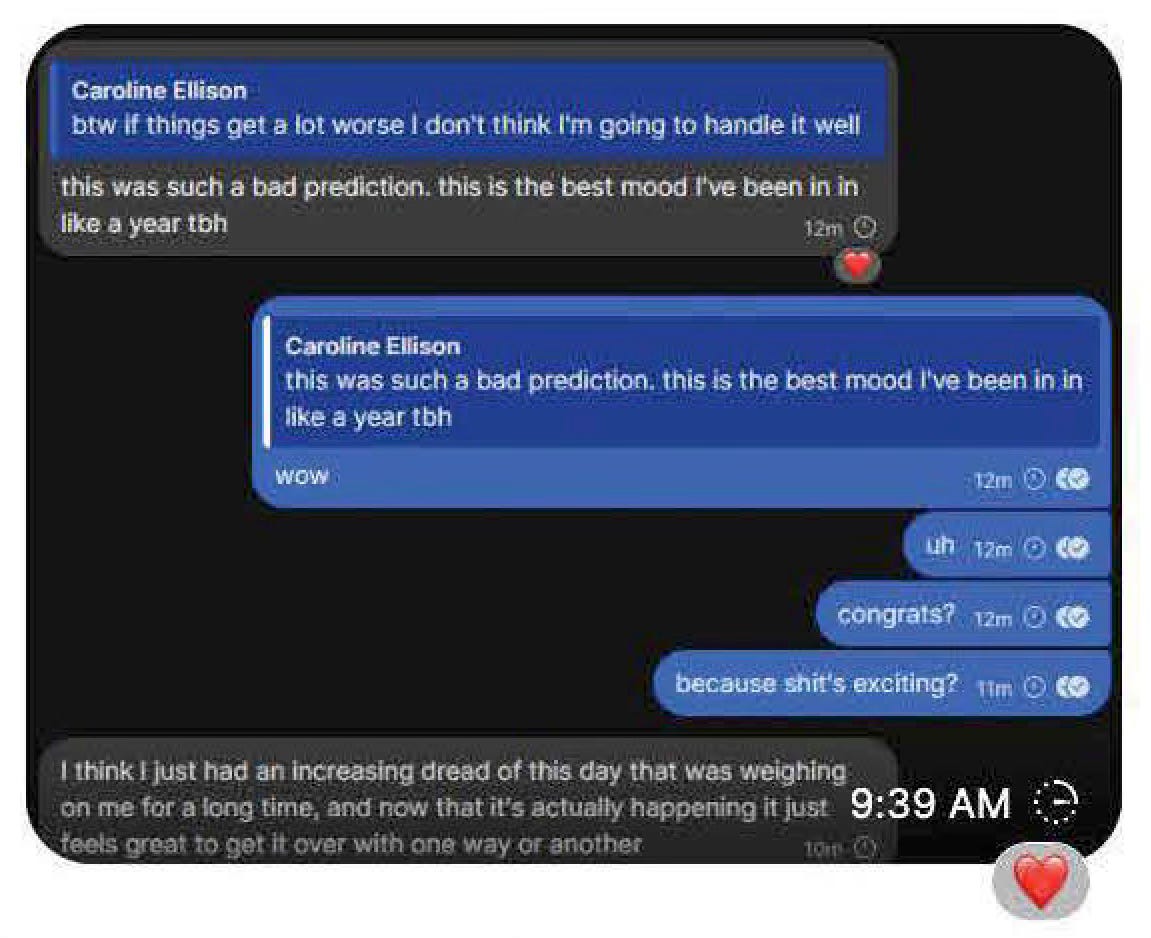

Caroline Ellison messages Sam Bankman-Fried

November 2022

[This document is from U.S. v. Samuel Bankman-Fried (2023).]

Previously: Notes from Caroline Ellison: “Things Sam is freaking out about” (Circa fall 2022)

Further reading from Elizabeth Lopatto for The Verge: Alameda’s paper trail leads straight to Sam Bankman-Fried (October 11, 2023)

Memo from Sam Bankman-Fried on “uncanny valleys”

I find it really fascinating to stroll through uncanny vallies.

Most people do not. Most people fucking hate it.

I often forget this fact, and fail to collapse wavefunctions that span the valley for way too long: because I actually don’t mind the tension of the valley, even though I know, intellectually, that almost everyone is their worst self in them.

—

Here’s an approximate list of what matters:

1) Being aligned and always doing whatever you think is best for the company

2) Being aligned and always doing whatever you think is best for the company

3) Being aligned and always doing whatever you think is best for the company

4) Being aligned and always doing whatever you think is best for the company

5) Being aligned and always doing whatever you think is best for the company

6) Being aligned and always doing whatever you think is best for the company

7) Being aligned and always doing whatever you think is best for the company

8) Being aligned and always doing whatever you think is best for the company

9) Being aligned and always doing whatever you think is best for the company

10) Being aligned and always doing whatever you think is best for the company

11) Being nice and fair to people

12) Being nice and fair to people

13) Being nice and fair to people

14) Being nice and fair to people

15) Being nice and fair to people

16) Working hard

17) Working hard

18) Working hard

19) Working hard

20) Working hard

21) Being smart

22) Having good instincts

23) Communicating well

Everything else is just the details.

So what’s the relationship between Alameda and Modulo?

1) In the end it should be very good. Alameda and Modulo are both very good at #1-23 above, and are both very aligned.

2) However, in practice neither side is confident that the other side is acting cooperatively.

Enter the valley.

For instance, when negotiating the IWM/QQQ trade.

If Alameda and Modulo were working together, they would maximize for the sum and do the trade if it’s positive sum. If they were 3rd parties who are independently profit maximizing, then they would negotiate back and forth on pricing.

Is Modulo part of the ‘Alameda family’, or an independent 3rd party firm?

The answer, really, is neither. The answer is that it’s sorta complicated and liminal and unclear. It’s in the uncanny valley.

And so rather than either resolving to a negotiation or to a net discussion, there was a wavefunction hovering over teh two, straddling the line.

And that caused miscommunications: where EDF’s terrible infrastructure was misinterpreted as price gouging, and where the time sensitivity of the trade was misinterpreted as disregard for Alameda’s time and costs.

The thing that went wrong: standing in uncanny valley of alignment, Modulo tried to use Alameda for order execution. Both sides had only some of the facts, and both sides felt the other was misaligned.

And lack of trust rebounds.

I, SBF, basically think both Alameda and Modulo are really aligned and make reasonable thoughtful decisions. But I don’t think there’s fully mutual knowledge about that. And so even though, at the core, both Alameda and Modulo are aligned with each other, they don’t fully realize this–and interpret things less favorably than they otherwise would because of it. Tension is created out of thin air, because the people involved don’t go into it 100% confident there couldn’t be tension. The possibility of tension created tension.

Anyway, maybe I’m wrong about some of the above. But I think it’s probably basically correct.

And so I think what needs to happen, here, is to collapse the uncanny valley. Uncanny valleys are complicated and probabilistic and mixed, but I’m going to take a stab at collapsing it anyway, onto my current best guess at the real truth. Hopefully I’m right.

There’s only one way to escape an uncanny valley: you have to collapse it to a single ground truth, and you have to create mutual knowledge of the collapse. Uncanny valleys can live on in peoples’ minds even if they’re otherwise eradicated, so the only way to really collapse the wave function is for everyone to agree that it has been correctly collapsed.

So here’s a doc, to collapse this uncanny valley. I’m sharing this doc (comment access) simultaneously to both Alameda and Modulo; you can both confirm that, so this creates full mutual knowledge of my attempt to collapse the wave function.

[This document is from U.S. v. Samuel Bankman-Fried (2023).]

The Tech Emails Library

The ultimate index of internal tech industry emails, with 200+ documents from Apple, Google, Meta, Tesla, and more. 🔍